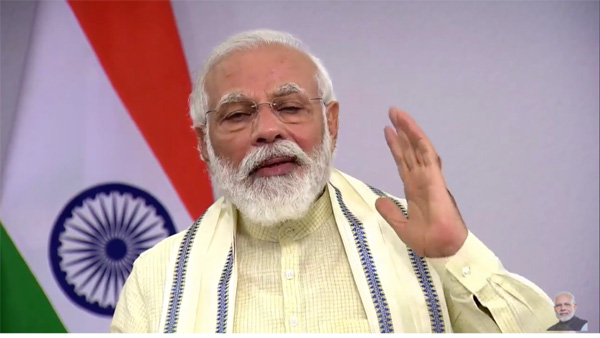

PM Modi to launch platform to honour honest taxpayers on Thursday

New Delhi, Aug 12: Prime Minister Narendra Modi will launch a platform for honouring the country's honest taxpayers on Thursday. The 2020-21 Budget unveiled on February 1, had announced a 'taxpayer charter', which is expected to have statutory status and will empower citizens by ensuring time-bound services by the Income Tax department.

"The upcoming launch of the platform for 'Transparent Taxation – Honoring the Honest' by the Prime Minister will further carry forward the journey of direct tax reforms,” the Finance Ministry said in a statement on Wednesday.

The Ministry said the Central Board of Direct Taxes (CBDT) has carried out several major tax reforms in direct taxes in recent years. Last year the Corporate Tax rates were reduced from 30 per cent to 22 per cent and for new manufacturing units the rates were reduced to 15 per cent. Dividend distribution Tax was also abolished.

"The focus of the tax reforms has been on reduction in tax rates and on simplification of direct tax laws. Several initiatives have been taken by the CBDT for bringing in efficiency and transparency in the functioning of the I-T Department," it said.

Recommended Video

In the Budget, Finance Minister Nirmala Sitharaman had announced that CBDT will adopt a "taxpayer charter" which will ensure trust between a taxpayer and the administration and reduce harassment, as well as increase efficiency of the department. CBDT, which is the apex decision making body in direct tax matters, administers personal income tax and corporate tax.

"Wealth creators will be respected in this country," she had said in her 2020-21 Budget speech. "We wish to enshrine in the statutes a "taxpayer charter" through this budget. Our government would like to reassure taxpayers that we remain committed to taking measures so that our citizens are free from harassment of any kind," she had said.

To facilitate better taxpayer services, CBDT has lowered the percentage of I-T returns picked up for scrutiny. Income Tax returns (ITRs) picked up for scrutiny has reduced to 0.25 per cent of the total ITRs filed in Assessment Year (AY) 2018-19, from 0.55 per cent in AY 2017-18.

The number was 0.71 per cent in AY 2015-16 and 0.40 per cent in AY 2016-17. Taking forward faceless assessment process, the Budget also proposed to bring about "faceless appeal". Currently, most of the functions of the Income Tax Department starting from the filing of return, processing of returns, issuance of refunds and assessment are performed in the electronic mode without any human interface.

Click it and Unblock the Notifications

Click it and Unblock the Notifications