Bonus for bank employees: Check eligibility, guidelines, examples, illustrations

Tentative list of eligible employees together with Bonus Calculation as per the data extracted from HRMS shall be provided to all Zones.

The

payment

of

bonus

act

was

recently

amended.

As

per

the

amended

provisions

ceiling

on

salary

and

wage

has

been

increased

from

Rs.10,000

to

Rs.21,000

per

month.

As

such,

employees

whose

salary/wage

does

not

exceed

Rs.21,000

per

month

are

now

eligible

for

bonus.

It has been decided to pay Bonus at the rate of 8.33% of salary to all the eligible employees for the period 01.04.2016 to 31.03.2017.

Salary for this purpose includes 1) Basic pay (including FPP & PQP) 2) Special Pay Dearness Allowance 4) Special Allowance with DA only. All the branches / offices may note to disburse the Bonus to all the eligible employees as per the procedure given here under.

Tentative list of eligible employees together with Bonus Calculation as per the data extracted from HRMS shall be provided to all Zones.

Zonal Offices should get the data verified and confirm the correctness of eligibility and amount of Bonus paid and payable.

Justification

For any modifications required to be undertaken in the list, Zonal Office should submit the details to HO with suitable justification. On receipt of the "Branch-wise difference and addition of Bonus payable details from the Zonal offices, the Bonus Amount will be credited to the "Cheque Proceeds Account" of the Zonal Office for onward distribution to branches.

Branches should enter details of Bonus paid in the Bonus Register for verification by the Labour Department Officials. The entire exercise of verification of calculation and Payment of Bonus to eligible employees should be completed by 25.09.2017.

Important guidelines

Bonus is payable to those employees whose salary does not exceed Rs.21,000 per month. In other words no Bonus is payable to those employees whose salary exceeds Rs.21,000 per month.

Every employee (including temporary employees) who had worked in the bank for not less than 30 working days during the financial year is eligible to receive the Bonus.

The maximum amount of Bonus payable to any eligible employee should be only Rs.7,000/- where an employee has worked for all 365 days.

For the purpose of computing the number of days during which the employee worked in the accounting year, he/she will be deemed to have worked on the days on which he/she has been on leave with salary / wages.

The minimum amount of Bonus payable to any employee is stipulated as Rs.100/- or the actual eligibility @ 8.33% whichever is higher.

In case, if the earning of an employee is reduced during a month on account of loss of pay, Bonus payable for that particular month should be calculated proportionately. An illustration is given in the Annexure-III

An

employee

will

be

disqualified

for

receiving

Bonus

if

he

is

dismissed

from

the

Service

of

the

Bank

due

to

(a)

fraud

(b)

riotous

or

violent

behaviour

within

the

premises

of

the

Bank

of

(c)

theft,

misappropriation

or

sabotage

of

any

property

of

the

Bank.

In

all

such

cases

the

matter

should

be

referred

to

Human

Resources

Department

(IR),

Head

Office

for

necessary

instructions.

In

case

of

employees

who

were

placed

under

suspension

/

dismissed

/

discharged

for

misconduct

prior

permission

from

our

Human

Resources

Department

(IR),

Head

Office,

may

be

sought

before

making

any

payment

towards

Bonus.

In

respect

of

those

employees

who

are

eligible

for

payment

of

Bonus

for

the

year

2016-17,

but

deceased,

the

Bonus

amount

shall

be

paid

to

their

legal

heirs

provided

a

claims

is

preferred

within

one

year

form

the

date

of

this

circular.

These

cases

should

also

be

referred

to

Human

Resources

Department

(IR),

Head

Office.

No advance against Bonus should be made pending receipt of salary particulars from other branches.

Leave encashment is not to be treated as salary/wages for the payment of Bonus.

Branches claiming Bonus pertaining to earlier years should route their claims through their respective Zonal offices duly substantiating the reasons for delay in making payment. Zonal office should confirm that the amount is not reimbursed to branches earlier. The amount may be Claimed separately and it should not be clubbed with the bonus amount related to this year.

Special points requiring specific personal attention of salary disbursement authorities and contravention of which will attract action against them.

Bonus register form

Bonus register in form "C" should be maintained for each year in which all the particulars of each employee are to be filled without leaving any column blank. Acquaintances should be obtained at the time of payment of Bonus from all the employees to whom Bonus is paid. At the time of inspection by Labour Enforcement Officer, all the relevant records should be produced before the concerned for verification. As per the payment of Bonus rules 1975, every branch shall send an annual return in Form "D" to the concerned Labour Enforcement Officer (Central) so as to reach within 30 days of payment of Bonus. A proforma of form "D" is given in the Annexure. All the branches are advised to note the same and submit the annual return without fail.

Examples

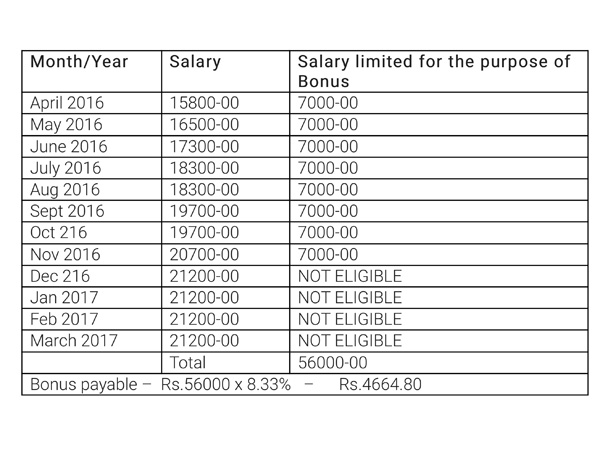

Example

1:

An

employee

has

drawn

salary

of

Rs.15800/-

for

April

2016,

Rs.16500/-

for

May,

Rs.17300/-

for

June,

Rs.18300/-

for

July

and

August

2016,

Rs.19700/-

for

September

and

October

2016,

Rs.20700/-

for

November

2016

and

from

December

2016

to

March

2017

Rs.21200/-.

Bonus

payable

to

the

employee

is

calculated

as

under.

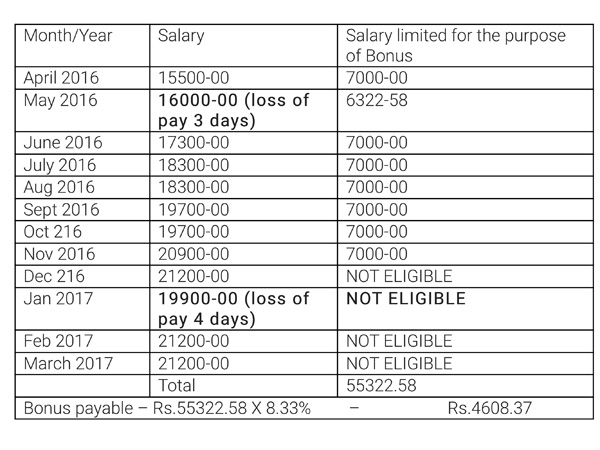

EXAMPLE

-

2

Where

the

salary

of

an

employee

is

reduced

on

account

of

loss

of

pay,

the

Bonus

payable

for

that

particular

month

should

be

reduced

proportionately.

Where

the

salary

payable

to

an

employee

is

more

than

21,000/-

per

month

but

the

salary

earned

for

the

respective

month

is

reduced

to

below

Rs.19,900/-

per

month

on

account

of

loss

of

pay,

he

is

not

eligible

for

payment

of

bonus.

The

Bonus

payable

in

the

above

cases

is

calculated

as

under.

OneIndia News

Click it and Unblock the Notifications

Click it and Unblock the Notifications