BRICS: From FDI destination to departure point

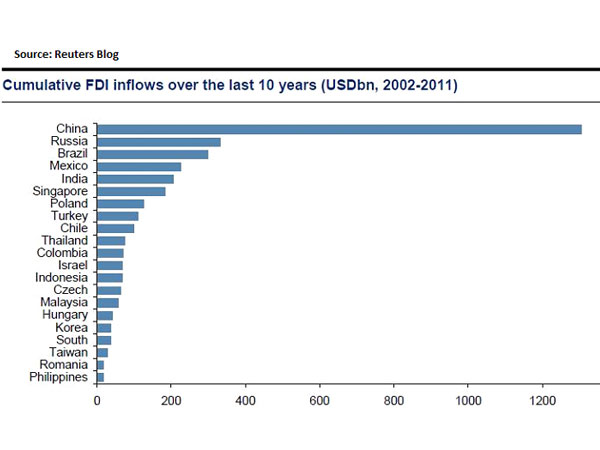

When Goldman Sachs economist Jim O'Neil coined the term "BRIC" in 2001, he grouped together four seemingly disparate nations: Brazil, Russia, India and China. They shared two characteristics; a large population and an impressive rate of economic growth. Investors seemed to share O'Neil's assessment of the four countries, and the next few years cemented the status of the BRICs as the darlings of foreign investors. According to the World Investment Report, in 2012, the BRIC countries managed to absorb nearly USD $263 billion of FDI, or 20% of the global total. The report also forecast this trend to intensify in the coming years, despite the concerns regarding the economic prospects of the BRIC nations.

While BRIC countries welcome the influx of funding, the mismatch between the needs of the recipient economy and the preferences of foreign investors persist. India, for example, has attempted to woo foreign money into infrastructure projects such as power stations and roads. Yet these sectors account for only 6% of inbound FDI.

In 2011, 50% of all FDI into China went into its real estate sector, fuelling a property bubble. Consequently China's top economic planning agency has officially discouraged foreign investment in areas it deems "oversaturated", such as housing and automobile. On the other hand, though Chinese government classified its renewable energy industry as a priority investment sector, there has been a lukewarm response from foreigners.

Brazil and Russia, in particular, have failed to attract foreign investment into their high tech and manufacturing sectors, which is necessary to diversify their economies from their dependence on commodities.

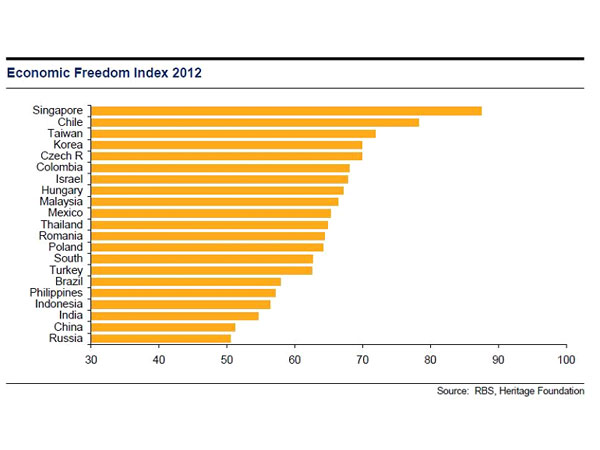

There is now a growing consensus amongst BRIC policymakers on the need to channel foreign capital into knowledge industries such as biotechnology, nanotechnology and robotics in a bid to move their economies up the value chain. Judging by current trends, this is no easy task, as BRIC countries are perceived to lack economic freedom.

According to the Economic Freedom Index (EFI) compiled by the Heritage Foundation, which tracks country performance on 10 criteria such as protection of property rights to fostering entrepreneurship, the BRIC countries are clustered at the bottom of the ranking. Economists have found a positive correlation between a nation's EFI score and the amount of FDI it can secure for its high tech industries. The threat of expropriation in Russia, as seen in the Yukos case, retrospective taxation over investments by Vodafone into India, Apple's struggle for intellectual property rights in China and Brazil's partisan judiciary are some examples undermining economic freedom within the BRICs.

Lack of competiveness, complex bureaucracy and uncertain policies are other reasons why BRIC countries fail to attract FDI in sectors deemed important by their policy makers. In the latest Global Competiveness Report published by the World Economic Forum, none of the BRIC countries featured among the top thirty most competitive economies. With the exception of Brazil, every other BRIC country saw a decline in their competiveness over the past year.

These factors not only deter foreign investors but also domestic investment. In the past decade, the BRIC's share in global FDI outflow has increased exponentially from a miniscule one percent to ten percent. While rising economic prosperity and global aspirations of domestic firms have fuelled outward FDI to an extent in BRIC countries, high costs and lack of investment opportunities at home have also contributed to the surge in outbound FDI. In some cases, FDI outflow from BRICs has begun to resemble a capital flight. For instance, 2011 saw $10 billion worth of Russian capital flow into property in EU countries. In Brazil, outward FDI has exceeded the value of inbound FDI.

One of India's largest conglomerates, the Tata Group, has publicly acknowledged that there are better investment opportunities outside India. A survey conducted last year indicated that 60% of Chinese millionaires would consider immigrating abroad due to uncertainties over government policies.

Aside from these systemic challenges, foreign investors continue to face structural barriers when investing in BRIC countries. A lot of industries where foreigners would like to invest continue to be out of reach. Analysts say FDI flows into BRIC countries could be adversely affected if their governments continue with protectionist policies.

For instance, foreigners have been pressing BRIC countries to open up their financial sector, attracted by high savings rates, but governments have been slow to respond. Such trade barriers are not only restricting FDI inflows into BRIC economies, but also hindering trade agreements in multilateral forums such as the World Trade Organization. For the moment the BRIC governments say they will continue to reject any demand to open up sectors and industries they deem strategic. And it is this opposition which is now beginning to unite BRIC countries in most multilateral groupings.

There are better investment opportunities outside India: Tata Group

It's not clear how long BRIC countries will continue to impose such restrictions on incoming FDI. In the past the BRIC countries witnessed strong growth on the back of cheap credit and strong global demand. As the result, the BRICs could afford to be selective over inbound FDI, while at the same time, removing restrictions on FDI outflows. But today, the BRIC countries are facing a completely different external environment. Falling export revenues and trade balances has led to steep decline in the value of some BRIC currencies. This has, in turn, led to higher government debt, rising interest rates and slower growth. Hence, BRIC governments have to work harder to attract FDI, particularly in their priority sectors, which are often uncompetitive and snubbed by foreign investors.

NEXT YEAR COULD OFFER HOPE

2014 could mark a recovery for the BRICS economies if not a resurgence. Firstly its two "weakest" members, India and South Africa, goes to polls next year. It is widely expected that the incumbent centre left government is to be replaced by a news dispensation led by centre right leader, Mr Narendra Modi. Throughout his twelve year tenure as the Chief Minister of Gujarat State , Mr Modi has cultivated an image of pro reforms and good governance. There is near unanimity amongst business houses - including international brokerages - that a Modi government would usher in much needed structural reforms to kick-start the economy.

Secondly South Africa also goes to elections next year. While it is likely that the ruling African National Congress (ANC) will retain power for a fifth consecutive time. The elections could mark the beginning of a true bi-polar parliamentary democracy in post-Mandela South Africa , if the principal opposition party - Democratic Alliance - manages to restrict an ANC victory to a simple majority.

Secondly the Chinese government has recently announced a series of dramatic reforms which aim to fundamentally transform the export giant into a more sustainable consumer driven economy. It is expected that the relaxation of the one child policy alone will yield economic dividends - through greater consumption - as early as next year, though several ground challenges remain to be sorted. A section of analysts are also of the view that the sharp fall in currency values in experienced by almost all BRICS economies could turn into a boon once the US economy picks up pace next year.

Nonetheless, this single biggest challenge for the BRICS -as an international body - is low trade and investment among their members. While the lack of complimentary products does prohibit intra-BRIC trade, BRIC investors themselves do not see much investment opportunities within their own block. Only two percent of outward FDI from BRIC countries went to other members last year. If the BRICS fail to bolster trade in the coming years, it's highly likely that world would take them less seriously. In the coming months, diplomats from these five nations are due to finalize an appropriate date for the 6Th BRICS scheduled to be held in Brazil sometime next year. It would perhaps be useful if they do some homework before coming or else they risk another "photo op "

(Siddharth Mazumdar is founder member of Citizens for Accountable Governance. He is a policy analyst from Columbia University.)

Click it and Unblock the Notifications

Click it and Unblock the Notifications