Is Priority Sector Lending truly benefitting the people who are left behind?

Did you know about Priority Sector Lending (PSL)? 40% of all loans given out by banks are set aside for the priority sector by the Reserve Bank of India (RBI). PSL was created to ensure support for sectors of the economy that do not receive adequate credit or support from financial institutions due to questions of profitability. In many ways, PSL reaches out to the same sections of society that our community of 12,000+ individuals do on www.rangde.org.

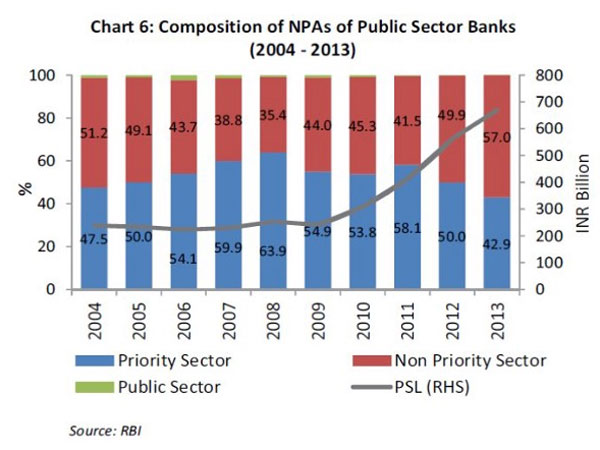

The spirit behind PSL is consistent and admirable. However, financial institutions blame the credit advanced to the priority sector areas for the increase in total non-performing assets.

This is not fair. Banks neither have the reach nor the inclination to reach out to communities living in remote locations. Many of them depend on intermediaries - usually other non banking financial institutions (NBFCs) or other Microfinance Institutions (MFIs) to fulfill their PSL targets. Often, the result is that credit is offered to the borrowers at inflated and unfair levels of interest.

A district cooperative bank in Osmanabad in Maharashtra waived off Rs 352 crores owed by two big sugar factories but is putting farmers in the area under extreme pressure to repay their debt. The bank has resorted to questionable practices as well - reclassifying the farmers' crop loans into term loans (which attract higher interest), applying additional interest for servicing loans, sending 'recovery' teams to villages. Ironically, farmers only wanted some time before continuing payments but are harassed while the factories and their owners who had no intention of repaying the money were scarcely bothered by the bank.

On top of facing humiliation and harassment due to unpaid loans at high rates of interest, many farmers who are supposed to benefit from PSL funds also struggle with successive crop failures, nonseasonal rains and successive drought.

To blame PSL for the high proportion of bad loans in the country is to miss the point; there is a deeper malaise in the system and there are roadblocks we are failing to address.

Most MFIs bundle together loans (those backed by assets) and transfer them en masse to banks who are looking to meet their PSL targets. Banks also agree to take on any risks attached to the loans made by the MFIs. So this means that MFIs provide loans using money that isn't paid back, essentially using money that isn't theirs. The banks, who inherit the risks associated with the loans, move onto selling the assets (farm land, houses etc) when the loans go bad.

Many MFIs, chasing bottom lines, often lend to the same set of borrowers, saddling borrowers with debts far beyond their ability to pay back. At its worst, securitization has spawned a system whose success is predicated on the failure of loans by the borrowers. The amount of credit at any time is finite and demand always outstrips supply.

A lot of effort has also gone towards recategorising priority sector lending to reflect the tastes of predominant groups. It is the only way how one can explain the seriousness with which gold loans are being considered under PSL following pressure put on the government by Muthoot Finance & other similar organisations.

The claim that gold loans would promote financial inclusion in the country is facetious at best and downright dangerous at worst. Gold, a symbol of financial security, is only sold or traded under dire circumstances. It is impossible to determine the purpose for which a gold loan is given out and hence the chance of it being used for non-income generating purposes is high.

63-year-old Pavanuammal, a widow from Cuddalore in Tamil Nadu, who needs funds to rebuild her house that was washed away in the Tamil Nadu floods in 2015 could easily be eligible for a gold loan. But we should not give her a loan at a high interest rate nor take her valuable gold assets away from her for what is not an income generating activity.

It is easy to lose sight of the spirit behind rules and regulations of lending to the priority sector. As Mahatma Gandhi said, there is enough for everyone's need but not enough for everybody's greed.

However, there is hope

In the 2017 Budget announced by the Finance Minister, there is a major reallocation of funds for most of the sectors under the priority sector. The Microfinance Units Development Refinance Agency (MUDRA) was allocated Rs 20,000 crores and a variety of schemes targeting rural development were introduced.

We hope that the funds reach the right category of beneficiaries in the right manner without the problems mentioned above. With digitisation and an increasing focus on financial literacy ensuring borrowers are given the correct information and skills and funds disbursed through the right intermediaries, there is no reason why the situation cannot turn around.

OneIndia News

Click it and Unblock the Notifications

Click it and Unblock the Notifications